|

Estate Planning Estate Planning Guide

Protecting Your Estate and Your Family

Although two-thirds of affluent individuals have some

kind of estate conservation program, only 11 percent of these

programs are current (less than two years old) and nearly

40 percent are six to 10 years old — dangerously out-of-date

by experts' standards.

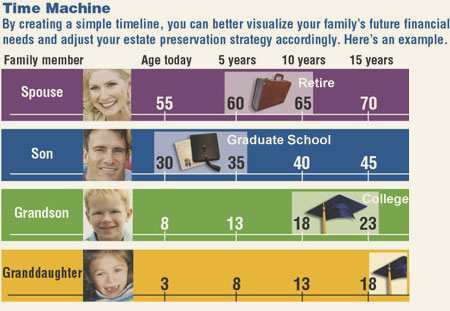

Many people have worked hard to accumulate assets for their

family's welfare and consider taking care of their heirs a

top priority. By periodically reviewing your estate conservation

strategy, you can help ensure that your assets are protected

and passed to your heirs as you intend.

Here are a few questions to consider when reviewing your current

strategy.

- When was the last time you looked at your will?

If it's been a while or you can't remember, it may be time

to review your will and determine whether any changes are

needed. Perhaps you have had a change in your marital situation

or new grandchildren whom you would like to include.

- Have you established a trust? If structured

properly, a trust can be a valuable tool to help protect

assets and provide funds for final expenses, estate taxes,

or other administrative costs. A trust may also help reduce

the amount of estate taxes due.

- Have you funded your trust? A common

mistake in estate conservation is setting up a trust and

then failing to transfer assets into it. By moving the desired

assets into your trust, you can avoid this costly mistake.

- Did you name an appropriate trustee?

Is your trustee someone you trust to manage your assets

and make sound financial decisions that will affect your

family? You might want to consider a professional trustee,

such as a bank or trust company, that can provide stability

and impartiality to this role.

The use of trusts involves a complex web of tax rules and

regulations. You should consider the counsel of an experienced

estate conservation professional before implementing such

strategies.

Considering these questions might help ensure that your family

and estate are protected. Call today if you want help in evaluating

your estate preservation strategy.

|